Where was your business in the spring of 2020?

By that time, mounting anxiety around the impact and longevity of COVID-19 was starting to set in. Most places were in some version of lockdown. All organizations were figuring out how to operate virtually. And many were wondering whether they would still be around in six months.

As it became clear we were settling in for the long haul, I wanted to help businesses assess their positions and decide what steps would get them through an uncertain situation. So in April 2020, I developed the COVID-19 Strategic Filter, a guide for quickly assessing companies’ status and what they needed to do in the short and longer term.

Over the past two-and-a-half years, I’ve helped several dozen companies apply this filter, then supported them through Giant Leap peer mentoring groups or by working directly with their CEOs and management teams. I’ve analyzed 47 of these companies to see what insights we can gain from their strategic positioning and actions during the pandemic.

I want to share those learnings with you.

Action starts with a reality check

First, let’s look at the COVID-19 Strategic Filter and what it was designed to accomplish.

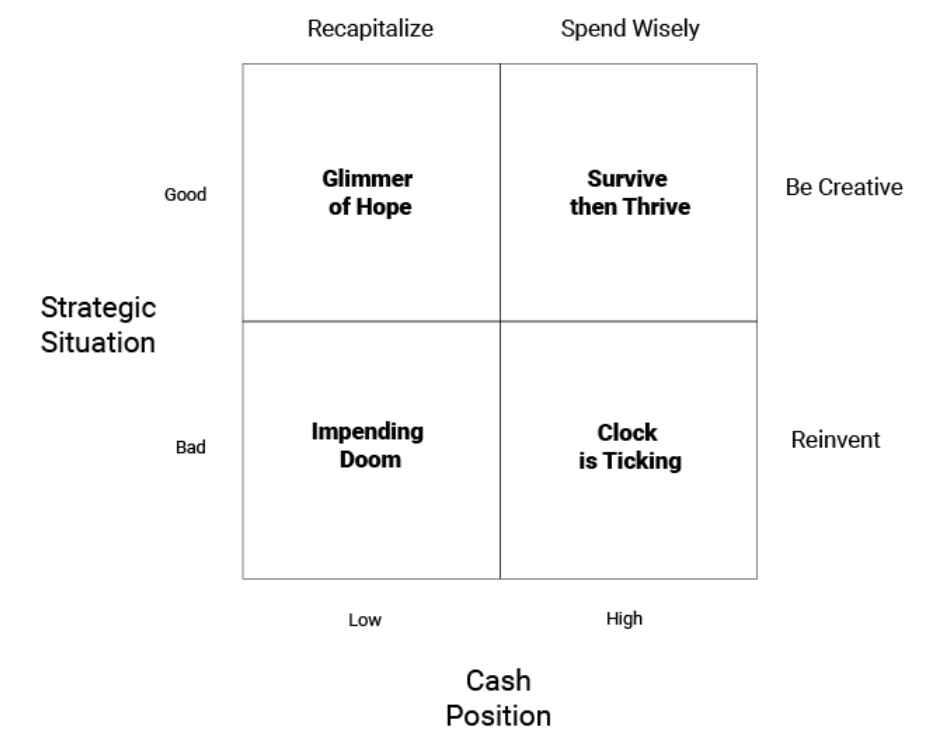

This tool provides an honest, straightforward check on the key determinants of a company’s resilience: how good its strategy is and how much cash is close at hand.

A business with a solid strategic situation is more likely to get through a life-threatening challenge than one that’s already facing instability. Well-tuned fundamentals, a robust customer base, a strong business model — these things matter.

For some companies, less ideal strategic situations were in play. Maybe they hadn’t gotten traction with customers. They might have faced disruption by an innovative upstart. Or they could simply be part of an industry that’s unable to operate during this type of shock.

More fundamentally, a company with cash reserves and a healthy balance sheet is more likely to manage disruption. The simple truth is that a strong cash position gives you more time to adjust to uncertainty. Meanwhile, cash-poor businesses had a very short window to make difficult decisions about retaining or laying off staff and maintaining or halting key investments.

Nearly everyone had to focus on some key areas.

- Managing cash proactively

- Delivering clear value to customers

- Being responsive to customer needs

- Performing essential activities

- Identifying and applying for government support

But those were just the table stakes. The strategic filter helped companies choose their next steps by identifying their strategic situation and cash position.

Diagram 1: Covid-19 Strategic Filter

Based on the quadrant they landed in, I recommended that businesses take two of four actions.

- Recapitalize: Provide enough liquidity to get through an indefinite period.

- Spend wisely: Conserve cash and increase the company’s runway.

- Be creative: Capitalize on the opportunities the pandemic generated.

- Reinvent: Find a viable business model or face a living death at best and failure at worst.

Deployed correctly, these actions would increase the chances of survival for vulnerable businesses and help those in a stronger position get back on track quickly.

What did we learn?

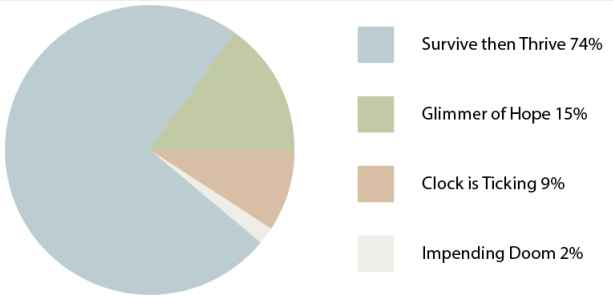

Using the COVID-19 Strategic Filter, we evaluated 47 companies in Canada and the US, and one in Mexico. They represented a range of 27 industries, from consulting to manufacturing to real estate to retail.

Many businesses felt confident, but there was plenty of risk to go around.

Diagram 2: Results of Covid-19 Strategic Filter

I had serious concerns about the eight companies in the “Glimmer of hope” and “Impending doom” quadrants. They were short on cash in the spring of 2020. Would they survive? What sacrifices would they have to make?

Looking back after 30 months, the results are fascinating — and impressive. No company in this group has failed, although 19% are struggling with current market conditions caused by supply chain shocks, uneven demand, and inflation. 49% are posting solid results and standing on a firm footing. And nearly one-third had their best year of all time in 2020 or 2021. Most of these are on track for a strong 2022

Seek out support

One factor had an outsized impact on these results: the large amounts of government money channeled to companies to maintain their workforces. Of our sample, 81% of companies received support through the US Paycheck Protection Program (PPP) or Canada Emergency Wage Subsidy (CEWS) and related initiatives.

In addition to payroll support, owners in both Canada and the US were able to access additional funds directly. These were modest, but they helped them focus on steering their businesses through the pandemic. 64% of companies received modest direct support through the PPP or Canada’s Emergency Business Account (CEBA) program. Without question, the government funds helped companies through the uncertainty of the first six months of the pandemic.

A closer look is revealing. 18% of the businesses we studied were short of cash, and these funds were critical to their continued existence. It bought them time and the staff continuity to enact changes in their businesses. These included cost reduction, improved efficiency, and more targeted marketing and delivery.

Nearly half of all businesses and 61% of those that received government money put it to critical use. I believe that all would have survived without the money, but they would have further reduced both their staff and the scope of their business without it. These funds provided breathing room and reduced management’s focus from dodging an existential threat to negotiating challenging but navigable waters.

Finally, for 21% of the companies, the money was welcome but not strictly necessary. That isn’t to say it wasn’t used wisely.

In several of these cases, the companies were able to advance investments and projects they would have put on hold otherwise. A few added to their cash reserves. When companies received government support and posted their best financial performance, profit sharing and dividends both increased.

The fundamentals of winning

When we set out on this analysis, I anticipated some common themes. 81% of organizations posted improved or top-performing results, and several lessons stood out from their experiences.

- Strong balance sheets stayed strong

Significant cash and high-quality receivables, low debt with room to borrow, and a solid equity foundation represent an excellent position at the best of times. At the worst of times, they bolster you against disaster. - For revenue models, annuity drove predictability

Annuity models were especially prevalent for insurance and property management companies, but several consulting and IT services businesses have incorporated them into their business models in recent years. That provided predictability in an unpredictable time. - Multiple revenue streams meant cash didn’t dry up

In the case of a client who owns both restaurants and liquor stores, the retail liquor business outperformed early in the pandemic. Meanwhile, the shutdown severely affected their restaurants. The retail breathing room gave the service company time to figure out a profitable carry-out business and outdoor seating for in-person customers. - Crisis-specific strengths drove success

It’s not surprising that businesses in industries the pandemic favored weathered the storm well. Home décor and gardening, building supplies, direct-to-consumer retail, and outdoor recreational goods all surged. - Perseverance demanded an embrace of change

Businesses that thrived were quick to shift online. Just like individuals and families, every business learned to use Zoom, Teams, and Google Meet early in the pandemic. The tools improved, and so did our ability to use them.Several companies in our analysis rapidly and proactively shifted everything they could online. For those in consulting, the shift provided an array of new offerings. For manufacturing and retail, it brought a fledgling channel to the forefront. In some cases, it shifted a company from bricks and mortar to online. Now these organizations are seeing the increased margins that often go along with online business.For everyone, the online pivot significantly expanded potential target markets from regional to national, and even international.

The struggle is real. And revealing.

It wasn’t all wins. What about companies that struggled through the past 30 months and still face uncertainty? There are valuable lessons about resilience and adaptability there too.

- They were struggling at the outset

Periods of strength and struggle are a natural part of business. Unsurprisingly, companies that entered the pandemic from a vulnerable position had a difficult experience.Slow demand, competitive pressure, and fundamental industry shifts added stress even before COVID-19. In one case, the company was partway through a major pivot and hadn’t quite reached the other side. It’s much closer now, but the pandemic delayed the shift by about two years. - Low reserves mean less runway

A low cash position proved to be the most significant risk. Fortunately, quick government action assuaged it to some degree. Without government funds, I believe between one and four of the companies in this analysis would have downsized drastically or gone out of business. - Slow adaptation hindered progress

Organizations that struggled were uniformly slow to make meaningful change. Each was working through critical issues before the pandemic. In a few cases, the challenge of figuring out virtual work and continuing to service and supply customers was a tall order.Companies in this position had little bandwidth to grapple with their more fundamental strategic challenges. It’s a pattern I’ve seen across many companies in crisis. They didn’t know which way to shift, so they defaulted to just coping and waiting for market conditions to improve.

Have a plan? Do it now.

This isn’t just a macro story. Individual leaders shared their own reflections and learnings as well.

Nearly every one of the CEOs I work with has expressed a combination of gratitude and fatigue. They’re grateful for their people, their customers, and the government stepping in decisively and quickly.

But almost to a person, they’re experiencing the type of exhaustion that comes from month after month of long hours, dealing with unprecedented staff shortages, and changing public health guidance.

When I’ve asked what changes are most likely to endure, business leaders mention two things most often: flexibility and hybrid work. Nearly every company in this analysis has adopted an ongoing hybrid work plan, and a few have jettisoned their offices entirely. They’ve seen the future and embraced it.

That’s easier for some than others. While some leaders are embracing primarily remote work, nearly every company I asked has been eager to be together in person again. Not all have sorted out what this new hybrid approach will look like, but now they have the tools to make it possible.

Leaders also realize they need the ability and willingness to flex, to try new things, to do more of what’s working and stop what isn’t. For nearly all of them, there’s an appreciation that time may not be on their side, and they need to be proactive.

One peer group member summed it up with his company’s new mantra: “Do it now.”

You made it here. What’s next?

In a strict sense, the pandemic isn’t over. Many companies still feel the effects it set in motion: supply chain disruptions, increased prices for goods and labor, and inflationary conditions, all against the backdrop of war in Europe.

Several of the companies we analyzed have whiplash. They might have had a rough 2020, a passable 2021, and an uncertain 2022. Or 2020 was mild, 2021 represented their best year ever, and this year looks mediocre. That makes the view of 2023 and beyond murky at best. The virus isn’t done with us yet.

With that in mind, the enduring lessons of the pandemic will maintain their relevance — and urgency. But what are those lessons?

Certainly, the precepts for running an effective and resilient business apply just as much as before:

- Provide significant value to your customers

- Focus on margin while keeping costs in line

- Have a strong balance sheet

- Be flexible and willing to experiment

Keep the fundamentals strong, and you’re likely to weather the storms when they crash down on your shore.

But there are broader lessons. What this analysis truly reveals is that when the crisis hits, it’s time to take an honest, serious look at your position. For bouts of unpredictability, that boils down to your strategic situation and cash position. Capturing success in a crisis means choosing the correct path to solve for each — and executing promptly and well.

My message to business leaders facing a crisis? Identify the risks and levers that will keep your business afloat, and imagine opportunities unique to that crisis. Strategize accordingly.

Beyond that, maintain the rare element that every entrepreneur brings to their business: commitment, diligent effort, and the willingness to do whatever it takes to succeed.

Copyright © 2023 Giant Leap ®